tcp: Reimagining Accounting Reconciliation

Streamlining financial workflows for accounting teams through intelligent automation and intuitive design

Problem

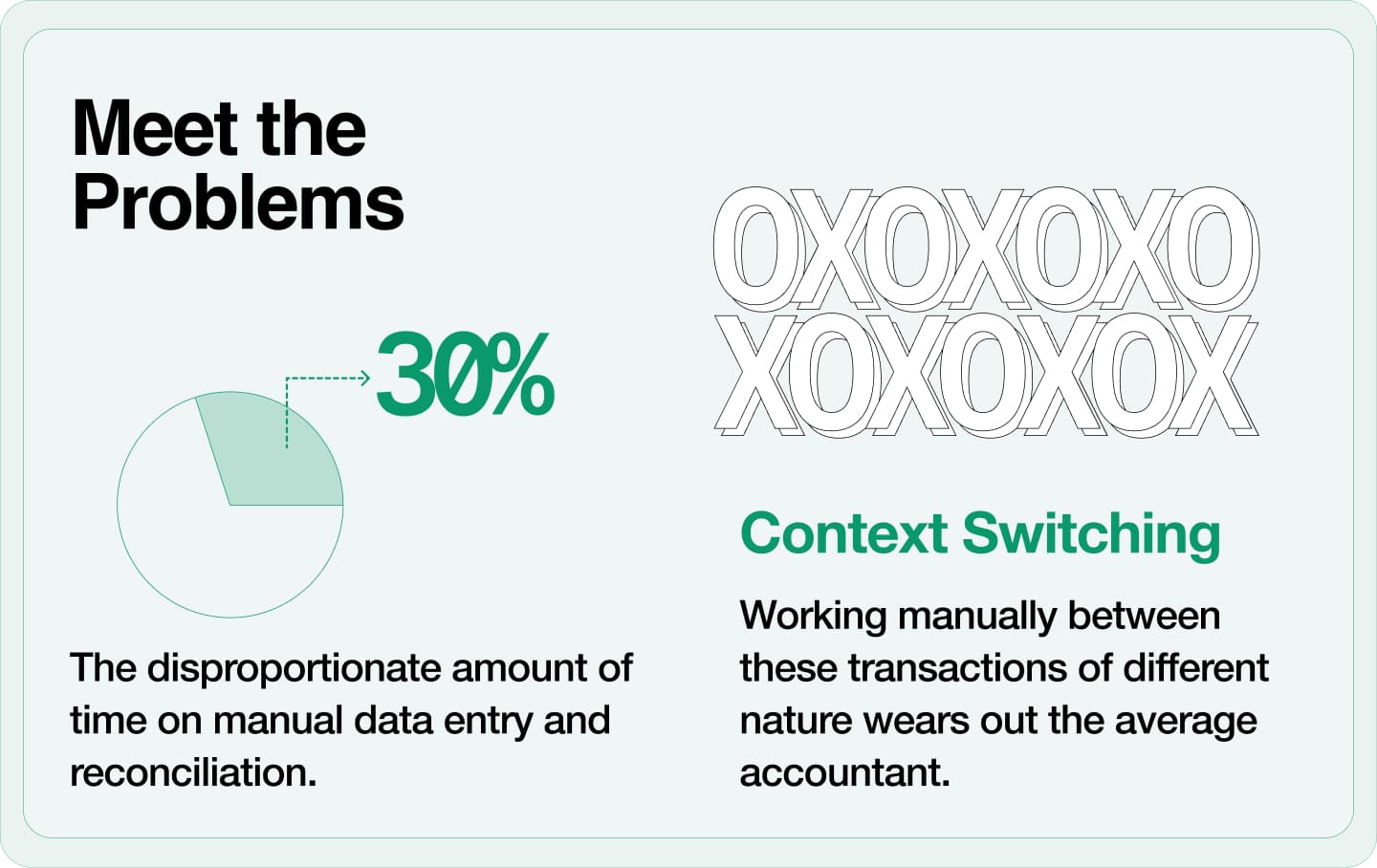

Traditional accounting reconciliation processes are manual, time-consuming, and prone to human error, leading to delayed financial reporting and increased operational costs.

Solution

An intelligent platform that streamlines reconciliation for uncategorized transactions from QuickBooks Online, enhancing financial accuracy, and compliance.

My Role

Product Manager & UX Designer

Timeline

5 months (Jan 2025 - May 2025)

The Problem That Wasn't What It Seemed

Understanding the pain points in traditional accounting workflows

Key findings from user research.

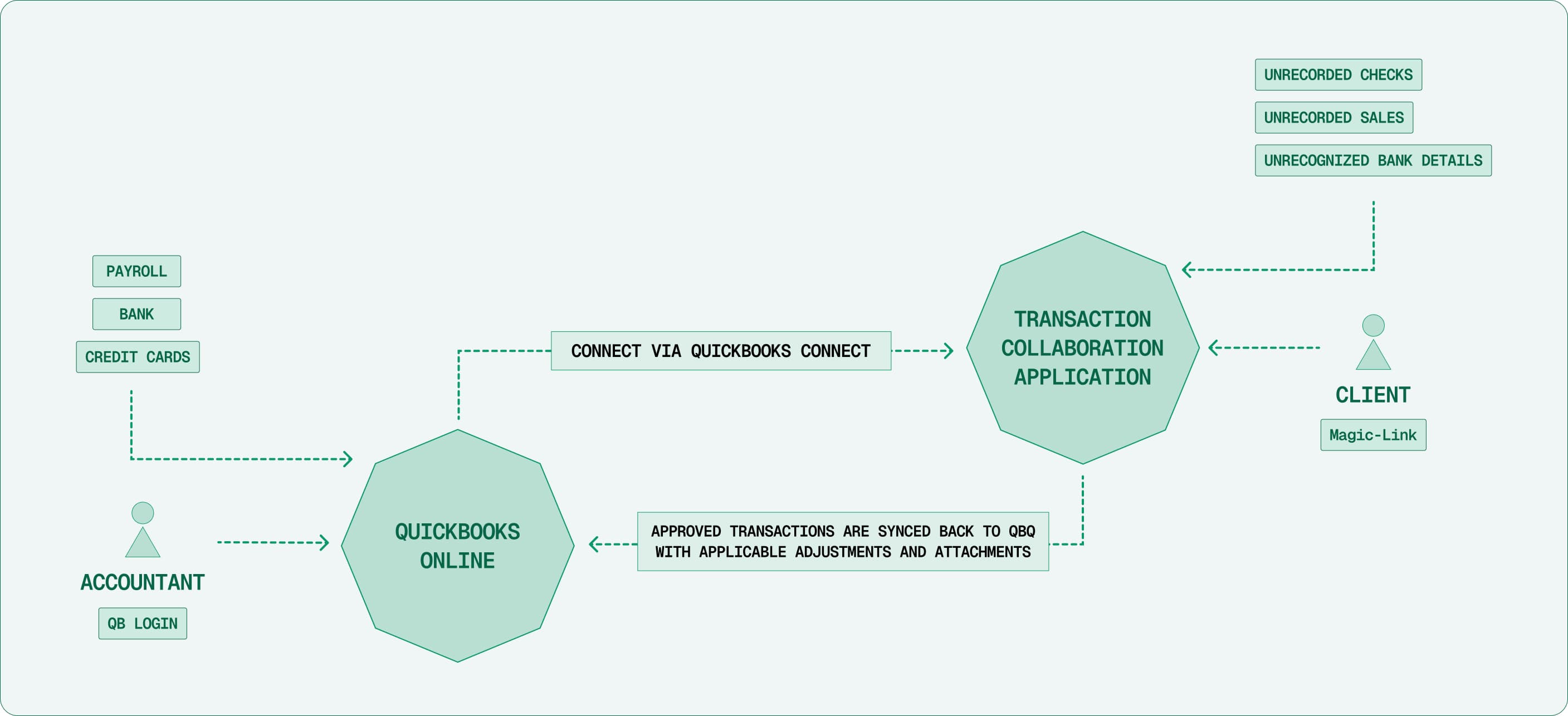

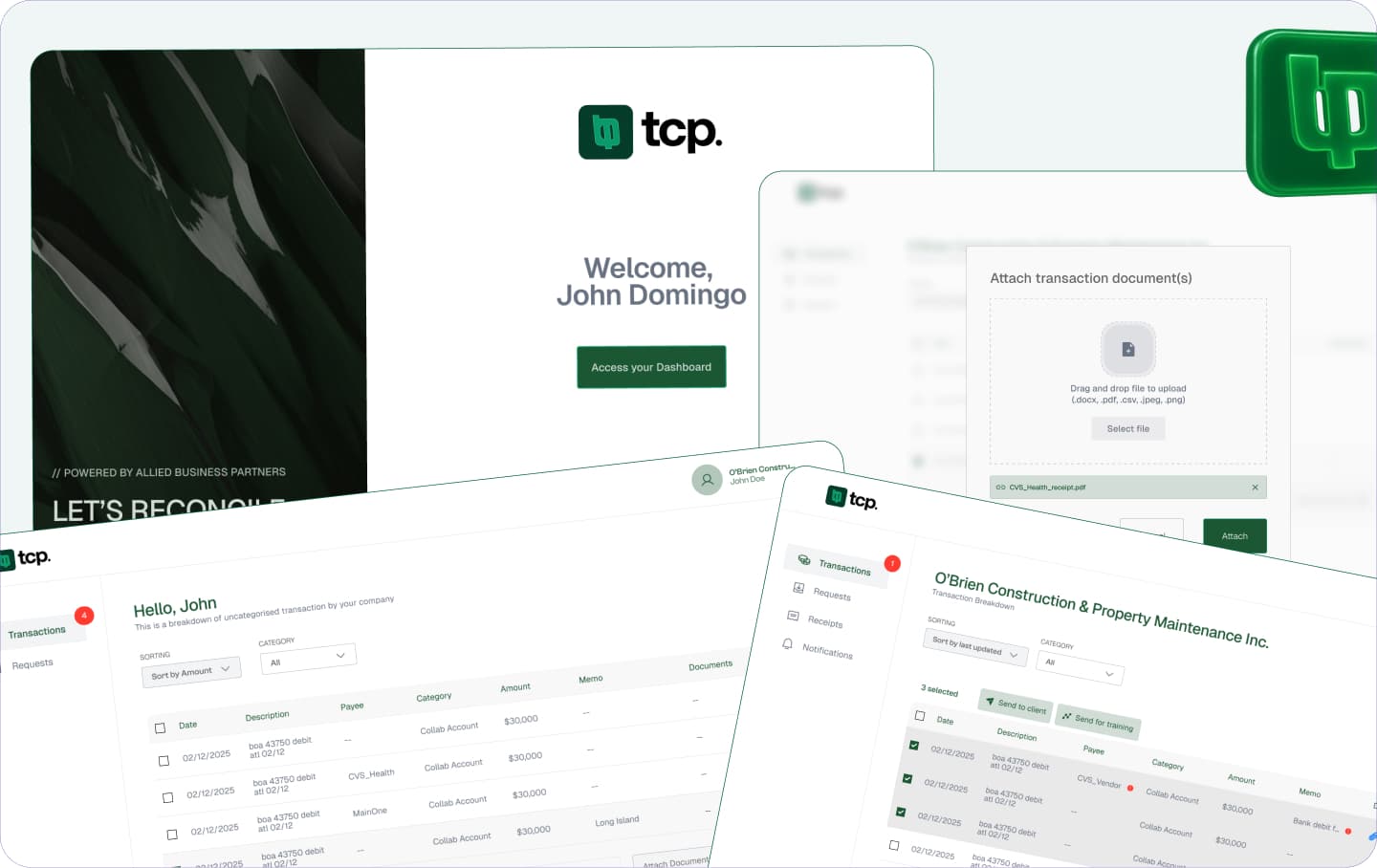

The Solution: Building a Collaborative Bridge

From concept to implementation

The Solution: Flow of the Experience

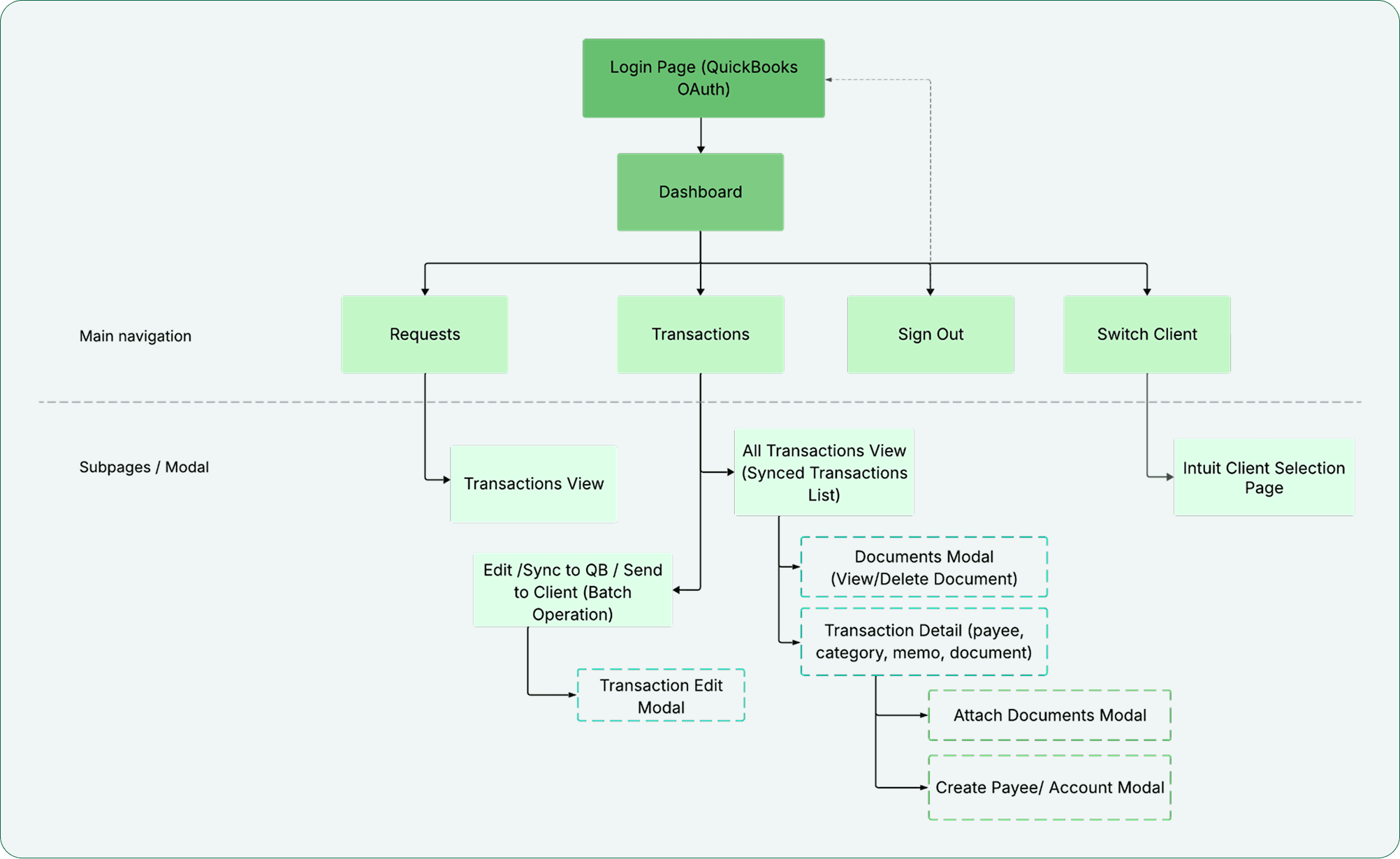

Design Process

Building intelligent solutions for complex problems

Design: Sitemap

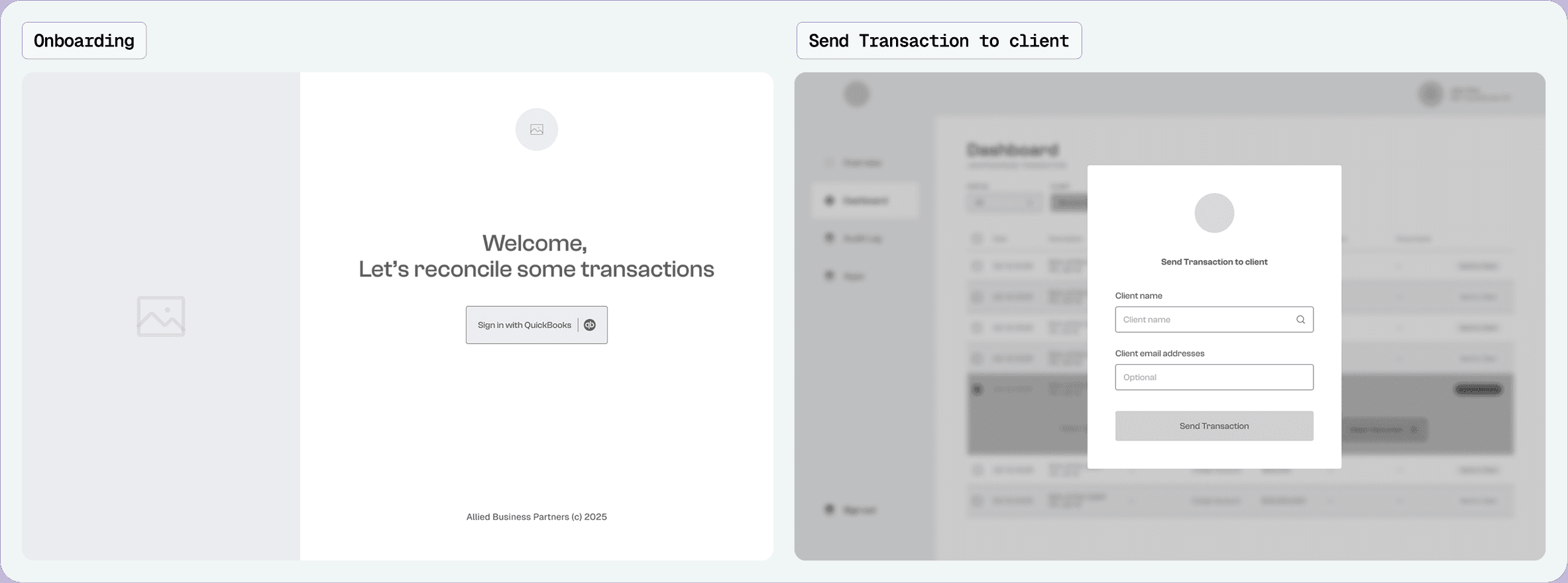

Design: Wireframe

Explore the Interactive Prototype

View TCP PrototypeThe Process: Balancing Strategy and Speed

Building intelligent solutions for complex problems

The Impact: Efficiency by the Numbers

Building intelligent solutions for complex problems

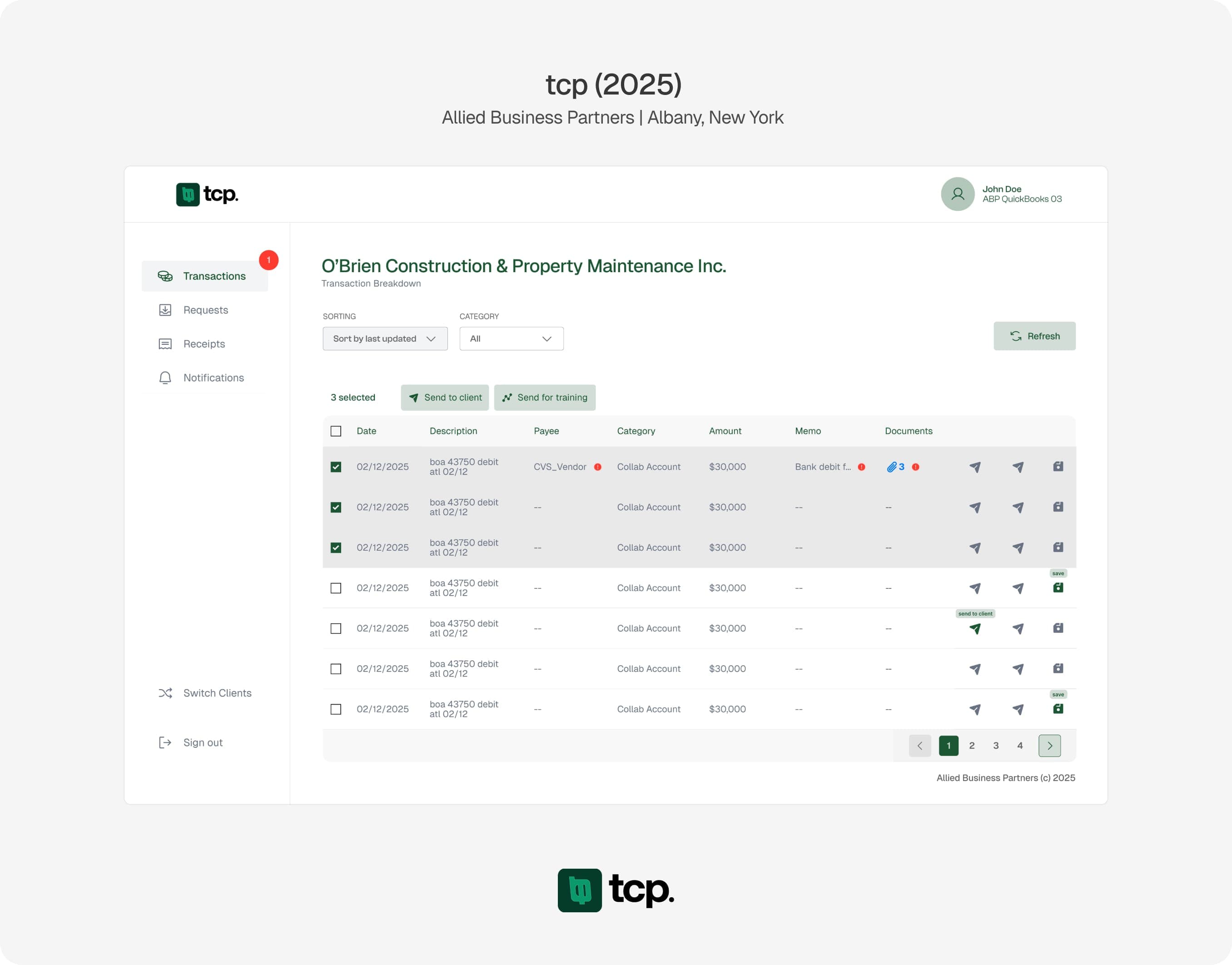

Transaction Collaborator Platform (TCP) Dashboards

Results & Impact

Reduction in manual client-accountant communication during testing.

Reduction in transaction categorization time.

Increase in ABP's service capacity without adding new employees

We predict that by the end of Year 2, TCP is poised to break even, where cumulative benefits outweigh the development costs. We built a way for accountants to start being the strategic advisors their clients need.